Assessment: Is your enterprise ready for AI customer service?

Before choosing the right AI customer service solution for enterprise scale, use this assessment to make sure your organization is set up for long-term success.

Learn More

AI in the insurance market has surged to $10.24 billion in 2025, but insurance customer service has a reputation problem. If you’ve ever tried to update a policy, check the status of a claim, or confirm coverage over the phone, you’ve felt it firsthand.

Long hold times. Confusing portals. Repetitive questions.

Behind the scenes, insurers are grappling with rising costs and staffing challenges. Seasonal spikes, natural disasters, and open enrollment periods can push teams to the breaking point.

Bottom line: traditional customer service models can’t scale. But using conversational AI in insurance can.

Conversational AI isn’t just an upgrade, it’s a new way forward. An AI customer service agent acts as your frontline policyholder rep. It can answer questions, process updates, and deliver always-on support across channels and at scale. The insurers who embrace it now are building AI customer service strategies that are faster and far more reliable than human-only models.

This is your guide to understanding how conversational AI in insurance is transforming customer service for both property and casualty (P&C) and health insurers, and why it’s quickly becoming the backbone of a modern insurance customer experience.

The key to thriving in this AI era is knowing exactly what’s needed to launch and grow a successful ACX program. Don’t wait for your competition to catch up. Download the guide now.

Get the guide

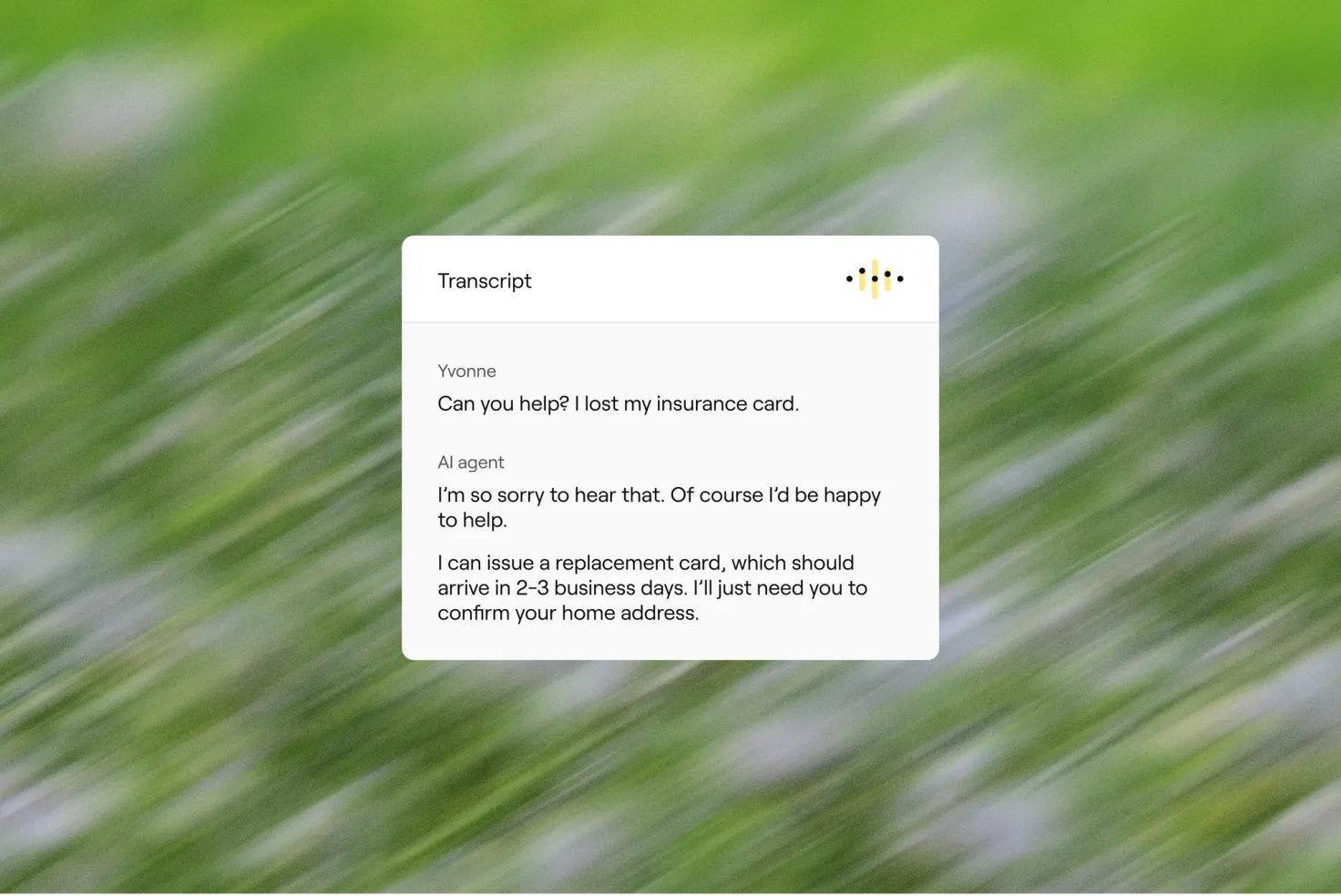

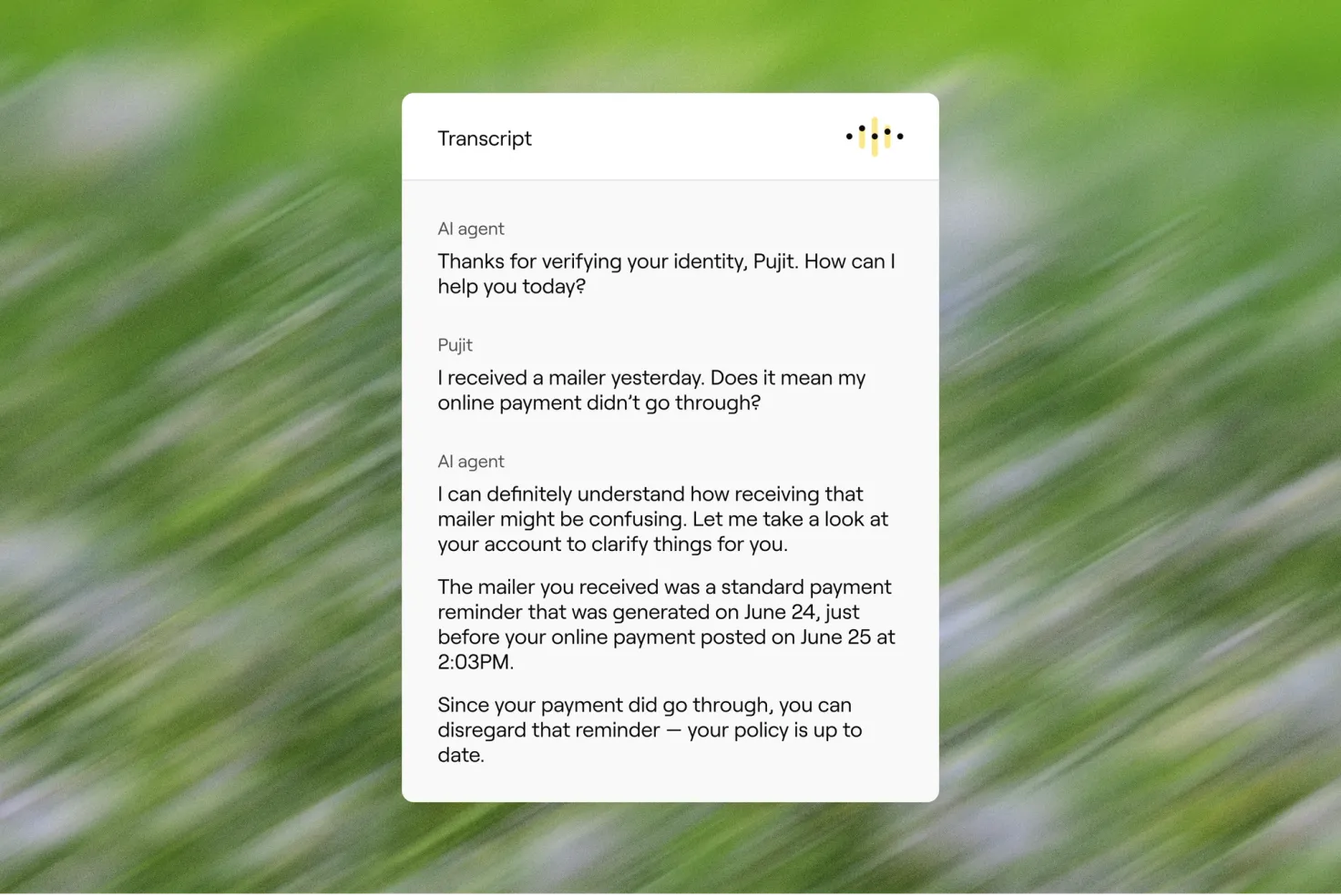

Conversational AI refers to AI-powered systems—like chatbots, AI agents, and virtual assistants—that interact with people in natural language. In insurance, AI customer service agents are trained to support complex workflows with accuracy, speed, empathy, and built-in trust through secure policyholder authentication.

The difference between a chatbot and an AI agent isn’t just technical. It’s operational.

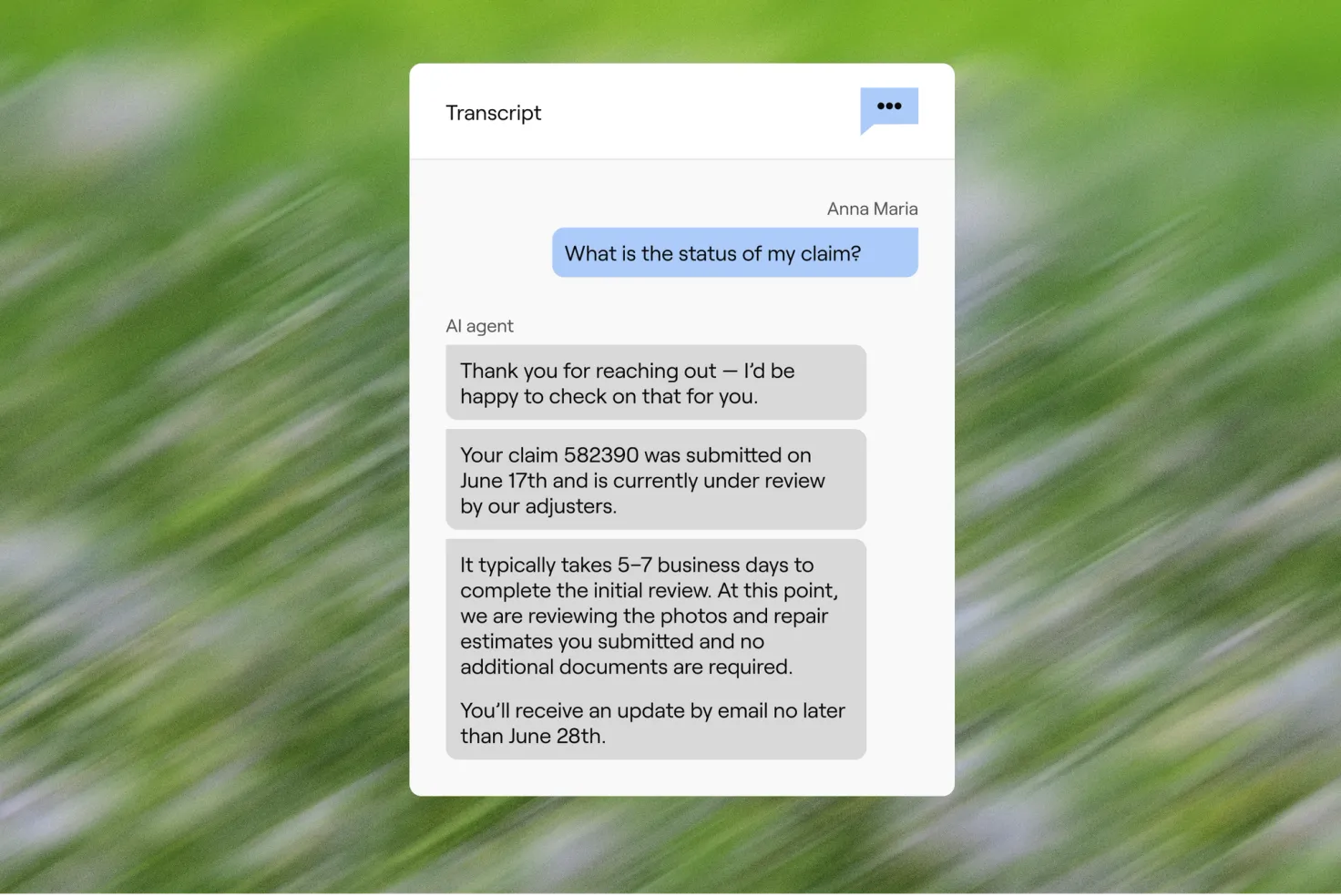

Chatbots follow pre-written scripts. They can help with basic tasks like listing office hours or linking to a help article. But when a customer needs to understand their deductible, update a policy, or check the status of a claim? That’s where chatbots fall short.

AI agents are built for complexity. They don’t just respond—they resolve. An AI customer service agent can:

An agent can handle questions, resolve tickets, complete transactions, and hand off to human reps, all while tracking performance and learning over time. Think of an AI customer service agent as a smart front-line employee who never sleeps, understands context, and always stays compliant.

In practice, conversational AI for insurance means:

The result is a policyholder experience that’s faster, smarter, and more scalable, even during seasonal surges or high-stakes moments.

Nearly nine in ten insurers are exploring generative AI, and 55% have already implemented it across claims, underwriting, and customer experience workflows.

Insurers are turning to AI agents as a core part of their customer service strategy. And the shift is being driven by real, measurable business pressures, like:

So what does this shift actually deliver, and how is AI in the insurance industry proving its value beyond the hype?

For insurers like Trust & Will, the impact goes beyond efficiency. Their AI agent, Will-E, handles routine inquiries with speed and accuracy, giving human agents the space to support customers through more complex, emotionally charged conversations.

Let’s take a closer look at the benefits of conversational AI and the outcomes insurers are already seeing.

The best conversational AI programs aren’t just fast and flashy. They actually move the needle on business outcomes that matter. That means they:

These aren’t just theoretical gains. Trust & Will’s AI agent, Will-E, maintains a 70% automated resolution rate and 75% CSAT, allowing their lean support team to stay focused on high-impact conversations, even during emotionally complex moments.

AI customer service agents are already resolving millions of insurance interactions every month. The most common AI use cases in insurance CX map directly to the highest-friction parts of the customer journey—from claims and billing to benefit navigation and ID card retrieval.

Let’s break it down by line of business.

Property and casualty insurers aren’t just juggling claims and coverage. They’re doing it under constant pressure to move faster, cut costs, and stay consistent, even when volume spikes. Whether it’s natural disasters, mid‑term claim surges, or waves of annual renewals, service demand can surge at any time.

That’s why more insurers are putting AI agents to work, automating the high-volume, repetitive interactions that slow teams down, so human agents can focus where they’re needed most.

Here are five of the most valuable AI use cases in P&C insurance:

From claim status inquiries to policy renewals, our Playbooks show how AI agents resolve the most common to the most complex customer requests—fast, safely, and at scale.

Explore Playbooks Library

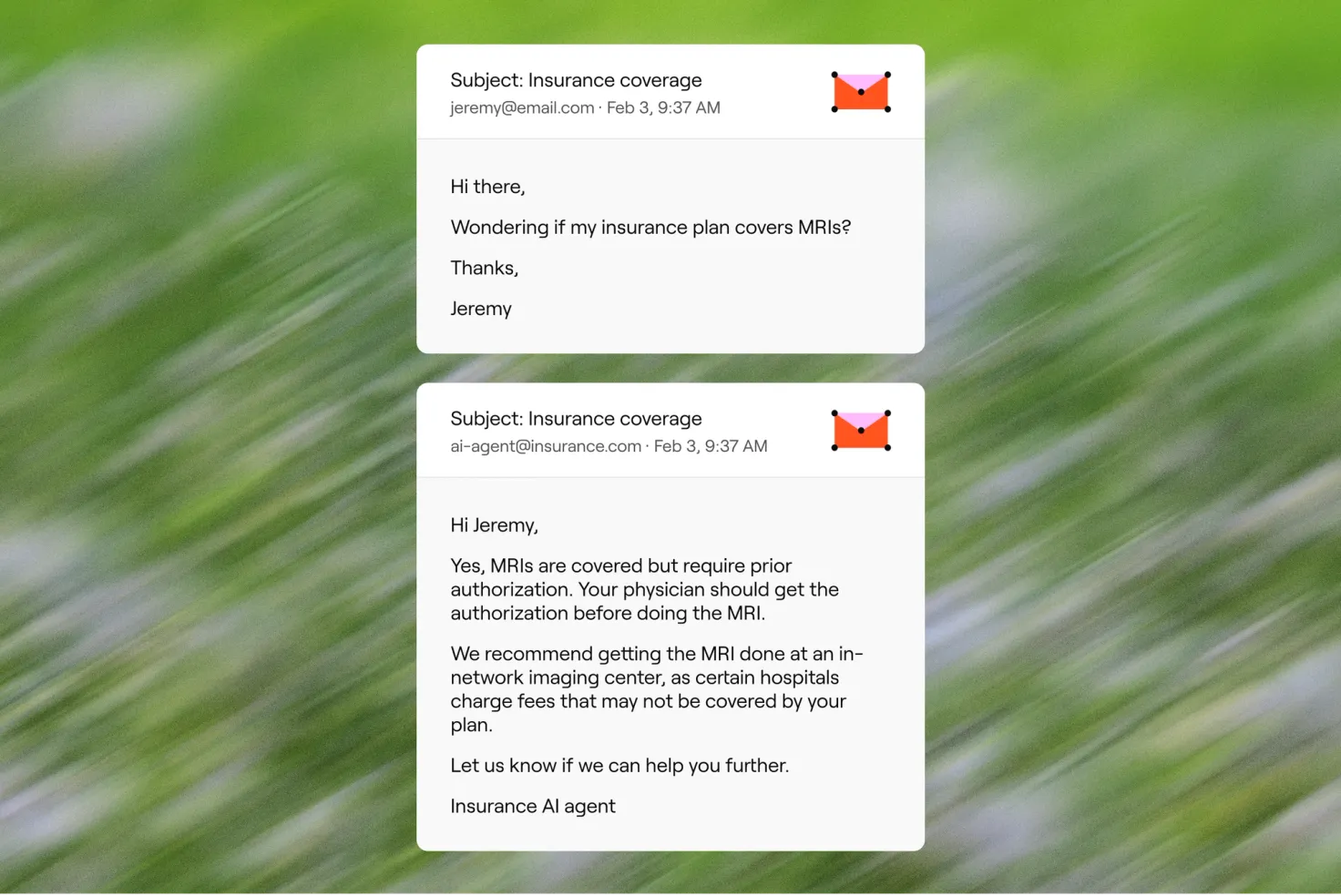

Health insurers are expected to deliver fast, accurate answers across a complex web of plans, benefits, and compliance rules—all while managing seasonal spikes, rising costs, and overworked support teams.

In the U.S. alone, over $100 billion in avoidable healthcare costs are tied to underused preventive care—much of it caused by gaps in communication and follow-through.

AI agents take pressure off the front lines by resolving high-volume, high-friction member requests instantly and accurately. From benefits confusion to eligibility inquiries, they handle the work that used to bog agents down.

Here are five of the most valuable AI use cases in health insurance:

Whether it’s answering a billing question or updating a policy, AI agents are already transforming how insurers handle day-to-day service, reducing load on teams while delivering faster, more accessible experiences for customers.

But not every inquiry starts with a keyboard. When urgency spikes—a claim, a care concern, a payment problem—many customers still reach for the phone.

From claim status inquiries to policy renewals, our Playbooks show how AI agents resolve the most common to the most complex customer requests—fast, safely, and at scale.

Explore Playbooks Library

When a customer calls their insurer, it’s rarely a low-stakes interaction. They’re calling because something’s gone wrong: a claim needs attention, a prescription didn’t go through, a bill doesn’t make sense. These aren’t moments where insurers can afford friction, delays, or endless transfers.

That’s why more carriers are expanding their automation strategy beyond chat and putting AI voice agents to work on the front lines.

Voice is just another channel, but to customers, it’s the most human one. That’s why the best voice AI agents deliver the same great experience on the phone as they do in chat: fast, accurate, always on-brand.

Here’s what they can do:

For insurers, voice AI isn’t just a channel upgrade. It’s the key to modernizing high-stakes support moments without compromising empathy, safety, or speed.

That’s why the best voice AI agents for insurance aren’t cobbled together from chat scripts. They’re built with resolution, compliance, and scalability in mind. They integrate with your backend systems, follow strict policy logic, and speak your brand across every channel.

The result? Smarter conversations, faster outcomes, and service teams that can finally keep up with demand.

AI customer service agents are quickly becoming the backbone of how insurance leaders deliver service. From P&C to health, insurers are using AI to resolve claims, answer benefit questions, manage policy changes, and more, all with less reliance on human headcount.

And when you find AI with the right operating model, AI agents don’t just support your team—they become your team’s most scalable, reliable, and consistent performers. They resolve complex workflows across channels and systems. They help licensed agents focus on the moments that matter most. And they give CX leaders full visibility into what’s working, what’s not, and where to go next.

The results are already here. Higher CSAT. Lower cost to serve. Faster response times. And a better experience for every policyholder without compromising compliance, personalization, or control.

AI in the insurance industry isn’t hypothetical anymore. It’s operational. And the smartest insurers aren’t just adopting AI agents, they’re building around them.

So the only question left is: are you ready to make AI your most reliable policyholder rep?

Trust & Will wanted to extend the same blend of simplicity and empathy to their customer service. Enter an AI agent created with Ada.

See case study