Assessment: Is your enterprise ready for AI customer service?

Before choosing the right AI customer service solution for enterprise scale, use this assessment to make sure your organization is set up for long-term success.

Learn More

Insurance has a communication problem.

When policyholders reach out—whether to check the status of a claim, update coverage, or confirm a billing detail—they’re often met with long hold times, confusing portals, or inconsistent answers.

At the same time, insurers are under growing pressure. Rising claim volumes, regulatory complexity, and higher customer expectations have made fast, consistent service harder and more expensive to deliver, pushing many to explore AI solutions for insurance that can scale communication without scaling headcount.

AI in customer communications for insurers is quickly becoming a strategic imperative. AI customer service agents now power personalized, real-time conversations across voice, chat, and email, resolving complex requests instantly and accurately without human involvement.

The result is better CX, lower cost to serve, and a service model that actually scales.

So what does conversational AI in insurance look like in practice? And where should insurers start? Let’s break down how leading carriers are putting AI customer service agents to work.

AI in customer communications refers to technology that enables real-time, two-way conversations between insurers and policyholders across digital and voice channels. But there's a big difference between surface-level automation and true resolution.

Many insurers still rely on basic chatbots—tools built to follow scripts, surface help articles, or escalate to a human when things get complicated. These bots might handle simple requests, but they’re not equipped for the nuance or complexity of most insurance workflows.

AI agents go further.

They’re designed to understand intent, manage multi-step tasks, pull and update data from backend systems, and personalize every interaction using real-time context. They don’t just respond, they resolve.

AI customer service agents act more like a capable frontline rep than a support tool—available 24/7, fluent across channels, and built to improve over time.

Communication sits at the heart of every policyholder relationship. It’s also one of the costliest, most fragmented, and most visible aspects of the insurance experience.

Every email, chat, or phone call is a moment of truth and a chance to either build loyalty or introduce friction. For many insurers, those moments are adding up in the wrong direction.

Let’s break it down:

Using conversational AI in insurance can resolve these issues head-on without adding headcount or compromising quality.

The most valuable use cases for AI in insurance are the ones your team is already drowning in.

These are the high-friction, high-volume customer conversations that drive up costs and overwhelm agents. AI customer service agents help by resolving these requests from start to finish, instantly and accurately. Here’s what that looks like in action.

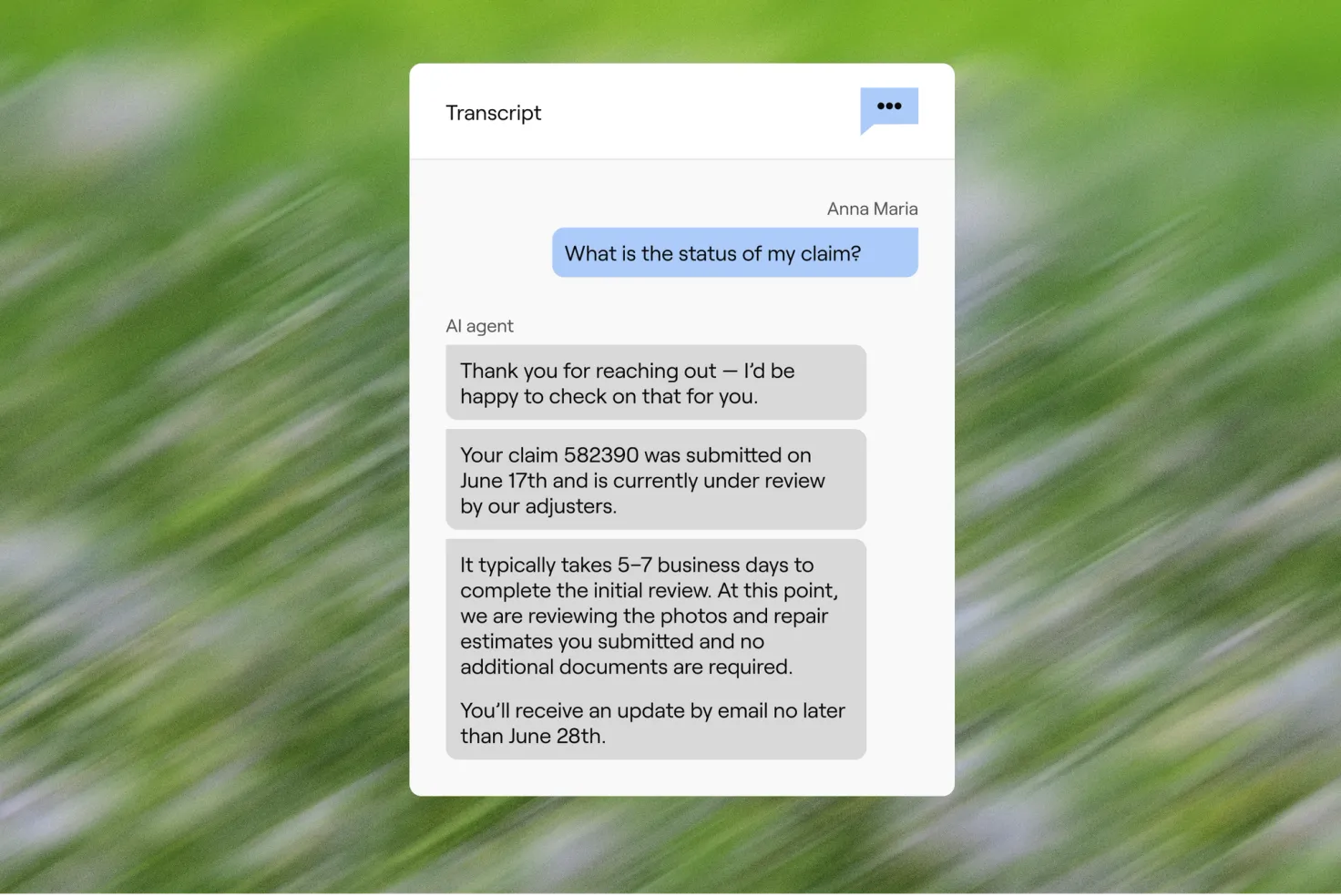

Customers checking on claims aren’t looking for generic updates. They want to know what’s happening, what’s next, and what’s needed from them.

These calls often spike after severe weather events, new plan years, or high-volume filing periods, creating backlogs that drive up cost to serve. Automating the initial status check, inspection timelines, and documentation reminders offloads the bulk of repeat contacts.

AI customer service agents retrieve real-time claim details, explain the current status, identify next steps, and send supporting documents. If the claim is stuck, they can flag missing info or escalate to a human with full context.

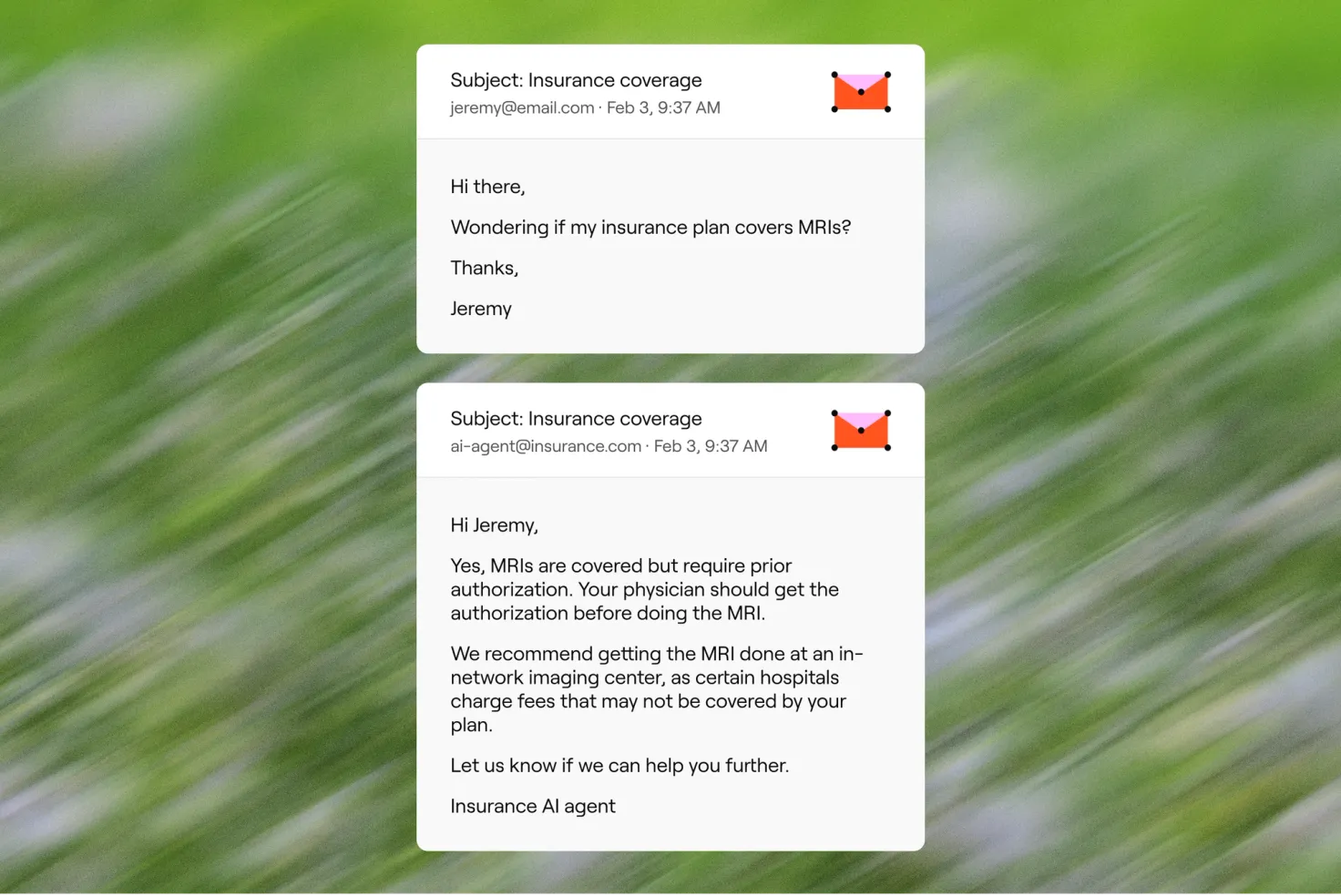

These questions are complex and policy-specific, and getting them wrong can result in churn or compliance issues.

Agents interpret the customer’s plan or policy, reference underwriting logic or plan rules, and explain coverage in plain language. They also offer next steps, like finding a provider or starting a claim.

Policy updates should be quick and painless, but they often require multiple steps, system checks, and follow-ups that bog down both customers and support teams.

Some of the most common repeat-contact drivers include address changes, dependent additions, and multi-driver updates. These often get delayed or kicked back due to missing information, making them perfect candidates for end-to-end automation with structured prompts and confirmation flows.

AI customer service agents handle the entire workflow, verifying identity, collecting change requests, checking eligibility, recalculating premiums if needed, and confirming the update. For renewals, they surface key dates, present updated terms, and collect payment to lock in coverage.

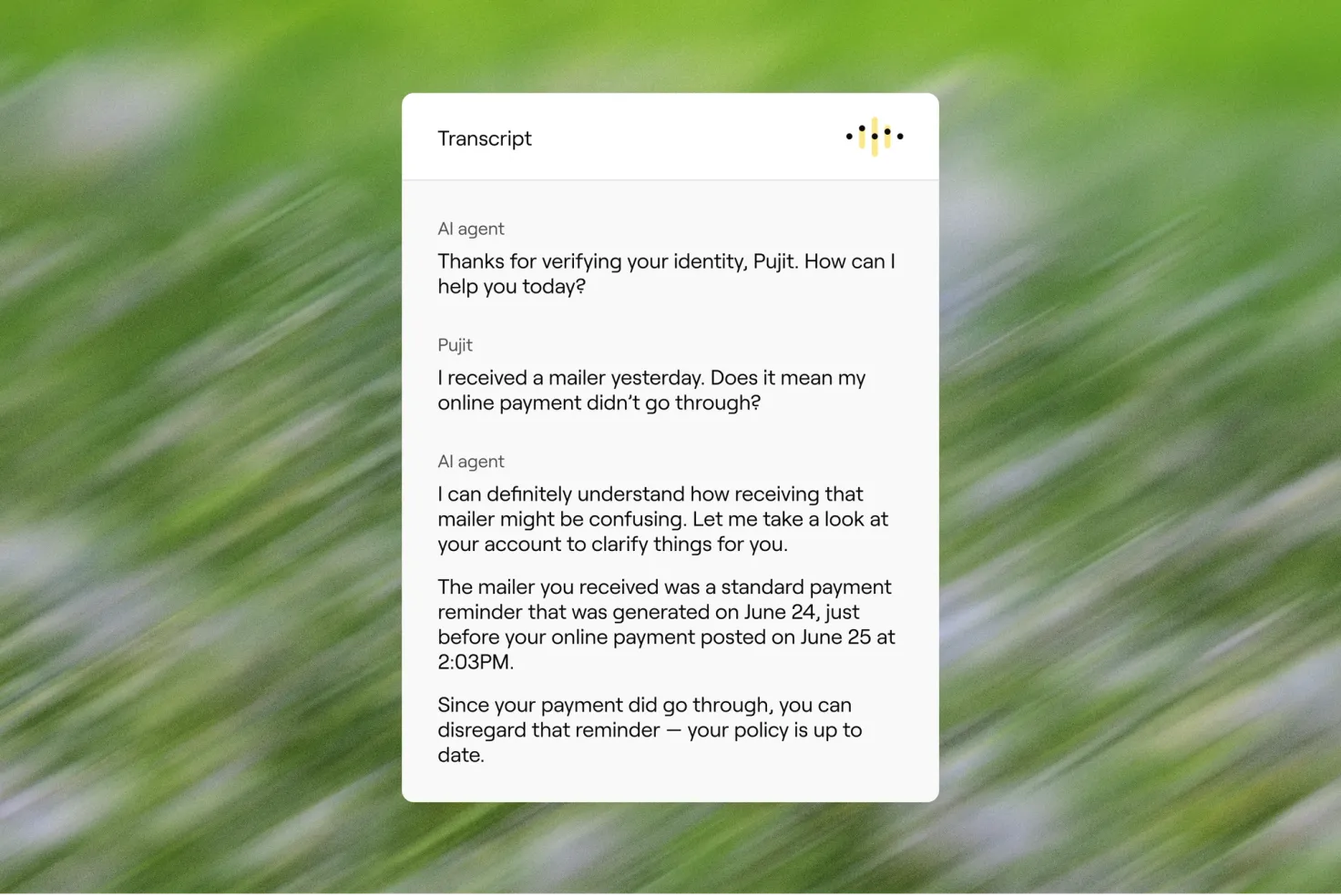

Billing questions are emotionally charged and often confusing, especially when they delay care or coverage. These conversations flood contact centers and can quickly erode trust.

AI customer service agents retrieve real-time billing data, explain charges line-by-line, surface due dates, offer secure payment options, and confirm receipt. They can also proactively notify customers before payments are due.

The best starting points for automation are high-volume, low-complexity intents, like balance lookups, premium due dates, explanation of charges, and secure payment collection. These make up the majority of billing-related inquiries and are ideal for deflection from phone queues.

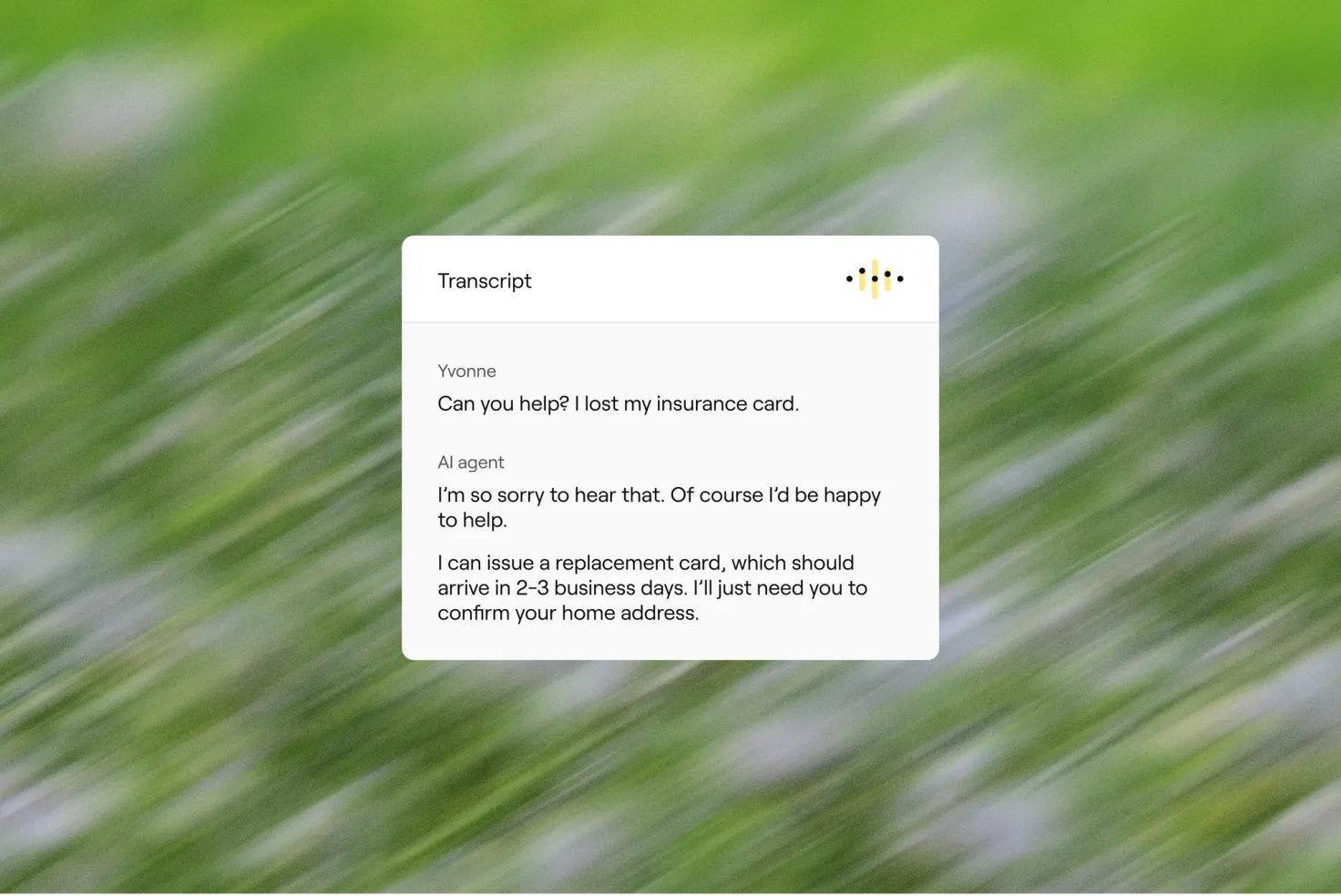

Whether it’s buying a car, scheduling a surgery, or applying for a mortgage, proof of insurance is often needed now, and customers don’t want to dig for it or wait on hold.

They authenticate the customer, retrieve the correct documentation based on the use case, and deliver it via the preferred channel—email, SMS, or in-app—instantly.

Finding care is a core part of the health insurance experience, but outdated directories and clunky portals make it frustrating and time-consuming.

Instead of forcing members to guess through drop downs, AI customer service agents ask a few natural-language questions—plan type, location, language, specialty—and return real-time results from provider directories. They can also filter for availability and offer directions or appointment links.

While this is primarily a health use case, a similar workflow applies in P&C for preferred vendors.

Digital-first doesn’t mean voice-last.

Even as chat, email, and self-serve portals grow in popularity, voice remains the most-used and most critical channel for high-stakes interactions in insurance. When a customer is filing a claim, disputing a charge, or navigating a health emergency, they want to talk to someone—or something—that can help immediately.

AI voice agents bring the same power of automation to the phone. But instead of static menus and endless transfers, they offer dynamic, natural conversations that resolve full workflows from start to finish.

Voice AI excels in urgent, high-stakes workflows where emotion or complexity runs high, like claims filing, billing disputes, or coverage denials. Chat is often better suited for multi-step, form-like flows such as policy updates, proof of insurance, or provider lookups.

Here’s what sets them apart:

Voice AI isn’t just a contact center upgrade . It’s the future of phone-based insurance service.

And when it’s part of a unified system, the best AI voice agents don't operate in a silo. It shares memory, context, and intent across chat, email, and SMS, so customers never have to start over, and your team never loses the thread.

Automated insurance conversations aren’t powered by a single feature. They’re the result of a coordinated system designed for performance, personalization, and safety.

Today’s best AI customer service agents are built on three core capabilities:

Escalations are minimized when AI agents follow approved scripts, verify against real-time data, and apply policy logic consistently. Built-in safeguards—like response validation and escalation triggers for ambiguous or high-risk topics—help preserve compliance while increasing resolution rates.

Layered into all of this are the guardrails insurers demand: enterprise-grade security, observability, and built-in controls for privacy, compliance, and brand alignment.

The most impactful place to start with AI in insurance isn’t a moonshot use case. It’s the everyday conversations that dominate your queue and quietly erode trust, efficiency, and satisfaction when they break down.

AI customer service agents give insurers a better way to manage those conversations. They handle the heavy lift across channels, personalize every response, and resolve requests end-to-end, so your teams can focus on the moments that matter most.

And while the technology behind these agents is powerful, the value is simple: faster service, happier customers, and a cost to serve that actually makes sense. The most effective AI solutions for insurance don’t just improve service, they reshape how it’s delivered.

So the question isn’t if AI customer service agents should handle your communications, i’s how soon you want the results.

Trust & Will wanted to extend the same blend of simplicity and empathy to their customer service. Enter an AI agent created with Ada.

See case study